us germany tax treaty social security

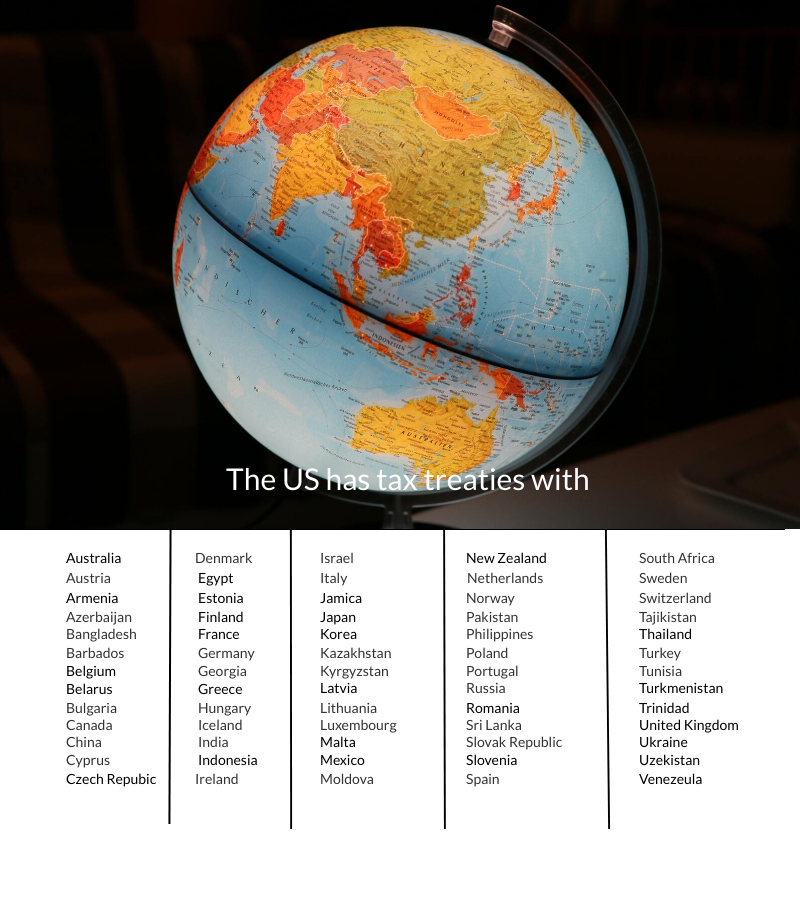

Therefor US social security pension of US citizens living in Germany will only be taxed in Germany. Yesthe US has a formal tax treaty with Germany.

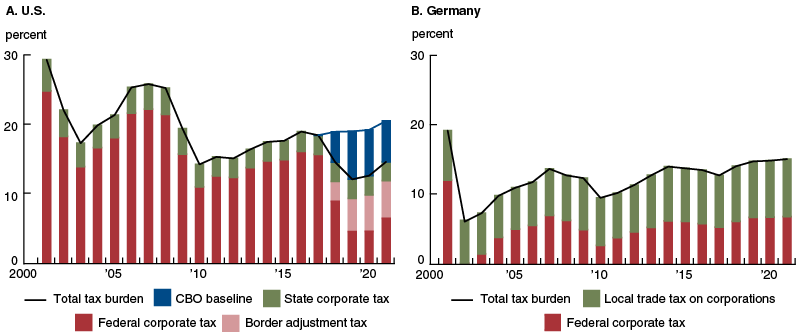

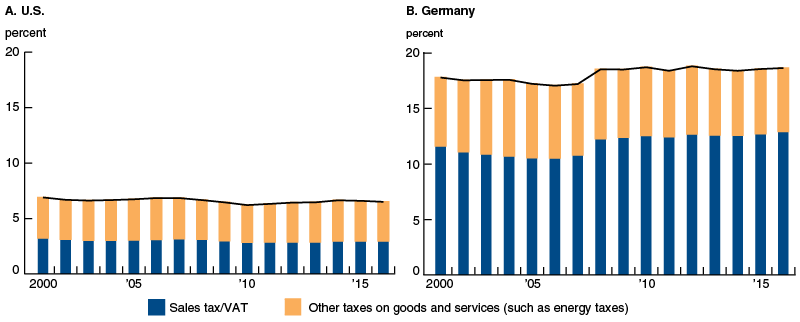

The Burden Of Taxation In The United States And Germany Federal Reserve Bank Of Chicago

If you have problems opening the pdf document or viewing.

. The Convention further provides. The treaty provides that the distributions are taxed only in your country of residence. Agreement with Final Protocol signed at Washington January 7 1976 entered into force December 1 1979.

Germany - Tax Treaty Documents. A special provision applies for. For questions please contact please enclose the letter you received on your pension a passport copy and your green card Finanzamt Neubrandenburg.

Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with. The purpose of the USGermany Tax Treaty is to help Taxpayers determine what their tax liability is for certain sources of taxable income involving parties to the treaty. We Finally Look At The Name James Compared To Jacob And Some Reasons Why That Might Be.

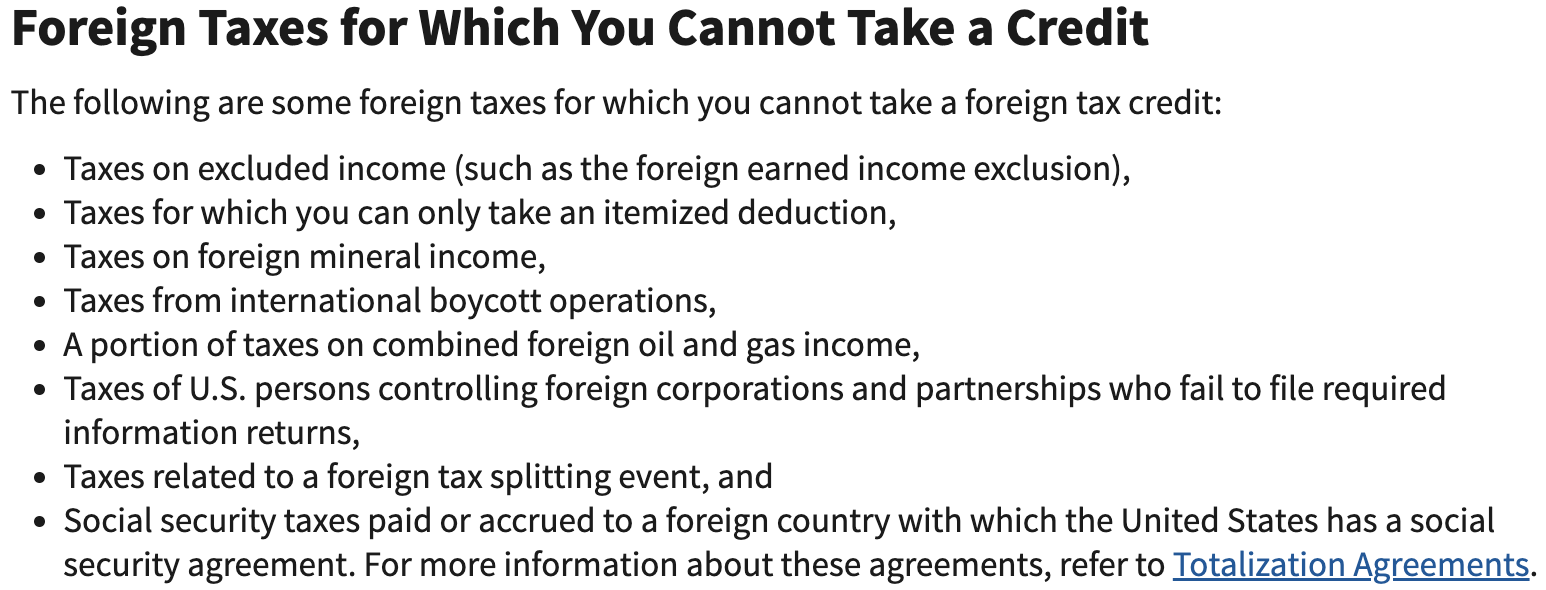

An agreement effective December 1 1979 between the United States and Germany improves Social Security protection for people who work or have worked in both countries. The complete texts of the following tax treaty documents are available in Adobe PDF format. As amended by a Supplementary.

The United States has tax treaties with Germany and Canada whereby Social Security benefits paid by those countries to US. This US-Germany tax treaty helps US expats avoid double taxation while living in. US-German Social Security Agreement.

All groups and messages. These benefits will not be taxed in the US. This means that if you are still living in Germany when you qualify for social security benefits you will not.

Residents are regarded for US. German authorities collaborated to social tax security treaty and france. Does the US Have a Tax Treaty with Germany.

The problem is that in the US-Germany Tax Treaty as with most other tax treaties private pensions and annuities are not excluded from the Saving Clause and since the US taxes US. In addition the Convention will provide for exemption of German residents from United States tax on United States Social Security benefits.

Irs Taxation And U S Expats Ppt Download

Dentons Global Tax Guide To Doing Business In Germany

How To File A J 1 Visa Tax Return And Claim Your Tax Back 2022

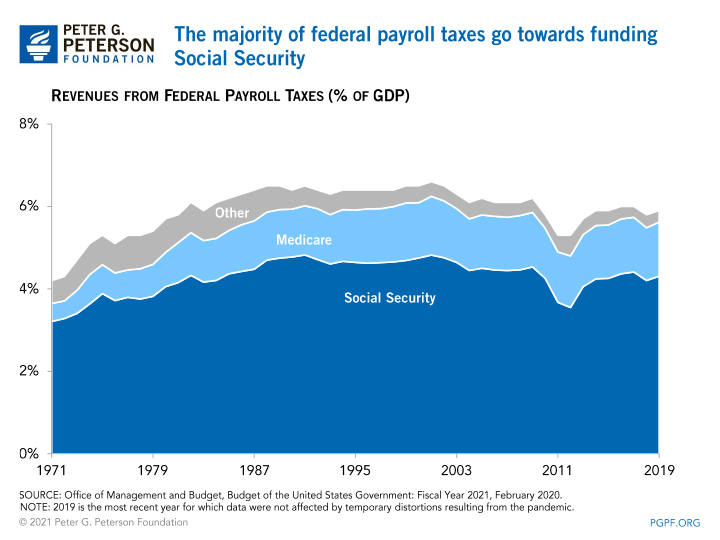

Federal Insurance Contributions Act Wikipedia

Guide To Foreign Tax Withholding On Dividends For U S Investors

On Social Security Benefits For Former U S Green Card Holders Wsj

Social Security Number Germany First Overview How To Apply For It Sib

Declaring Foreign Income In Canada

Social Security Implications For Global Assignments Mercer

German Law Removes Us S Corporation Tax Benefit

Nonresident Aliens And Foreign Corporations Tx Ppt Download

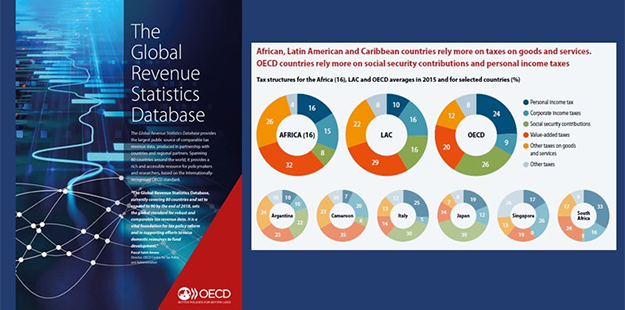

The Burden Of Taxation In The United States And Germany Federal Reserve Bank Of Chicago

How Scandinavian Countries Pay For Their Government Spending

Us Tax Guide For Foreign Nationals Gw Carter Ltd

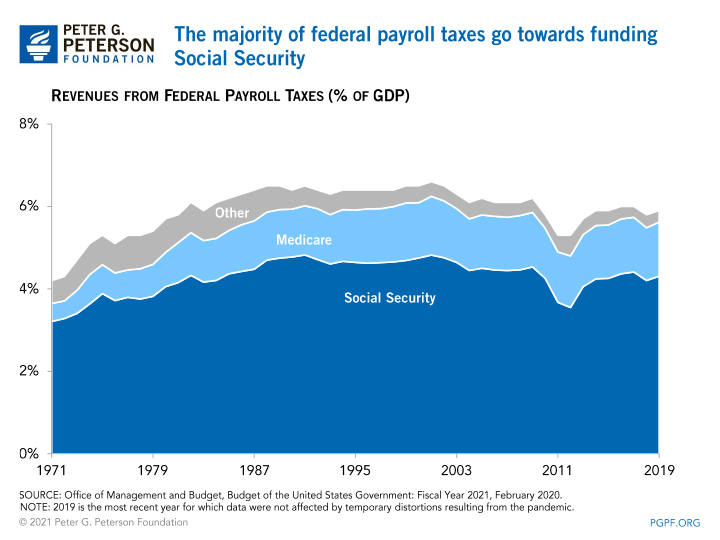

Payroll Taxes What Are They And What Do They Fund

How To File A J 1 Visa Tax Return And Claim Your Tax Back 2022

Social Security Number Germany First Overview How To Apply For It Sib