why are reits tax efficient

They are especially useful for financial requirements of institutional investors such as pension funds and for investors such as retired individuals seeking yield. Investment REITs.

Reits Offer Retirement Income And Much More This Retirement Life Investing For Retirement Retirement Portfolio Real Estate Investment Trust

Our clients tell us that we are easy to work with and highly-responsive.

. 0045 Returning to structuralist macroeconomics for unleashing Indias growth 0034 The ambience of policymaking. If you invest the same amount in the two REITs you get an. Why it is crucial for driving change in India 0021 A cotton crisis is upon us as climate change takes a toll on crops 0016 Investing abroad rules revamped to increase ease.

Vanguard funds not held in a brokerage account are held by The Vanguard Group Inc and are not protected by SIPC. Join Michael Plink and Jason Smull on inflation higher interest rates and the effect on bonds and equitiesIn addition they will discuss how. When a non-resident invests in US stocks or US-listed exchange traded funds ETFs the standard withholding tax on dividends is.

Do not deduct expenses such as the following. MoneyMagpie - For a richer life. Publicly listed REITs are much more cost-efficient because they are internally managed by people who are hired as employees of the REIT.

Return on assets ROA. The ROA tells you the overall profit a. Register now Vanguard Economic And Market Quarterly Review.

Including pension funds endowments foundations insurance companies and bank departments also invest in REITs as a cost effective and efficient way to gain exposure to the real estate asset class. Amazing tips and ideas for everyone plus weekly deals competitions and freebies. Any applicable deduction under section 179D for costs of energy efficient commercial building property.

Put high-yielding assets like real estate investment trusts REITs and taxable bonds into tax-advantaged accounts. Get breaking Finance news and the latest business articles from AOL. An income trust is an investment that may hold equities debt instruments royalty interests or real properties.

Crypto tax platform Koinly takes a closer lookSydney June 29 2022 GLOBE NEWSWIRE -- Tax-loss harvesting allows you to claim capital losses by recognising and selling your assets at a loss. The higher this metric the more efficient a bank is using its stakeholders money. Investing in medical REITs also carries certain tax implications to be mindful of.

For additional financial information on Vanguard Marketing Corporation see its Statement of Financial Condition. They consider us an extension of their team and appreciate the continuity of service. Attracting wealthy European business owners and.

From stock market news to jobs and real estate it can all be found here. To ensure this is a tax-efficient method of withdrawing money from the corporation it will be critical to consider both the tax on split. The data showed that while REITs have underperformed equities in the immediate aftermath of significant yield increases they have historically outperformed three six and 12 months after such.

The tax will not apply where the vendor of the subject item and the non-registered purchaser entered into a bona fide agreement in writing for the sale of the subject item prior to January 1 2022. Through a trust or a holding company. In the fast-moving world of business comprehensive and objective auditing continues to be invaluable.

Nareit serves as the worldwide representative voice for REITs and real estate companies with an interest in US. Since REITs are treated as pass-through entities REIT investors can avoid the double taxation associated with. Q2 2022 As a continuation of our VanguardTALK webinar series we will hold our next Vanguard Economic and Market Quarterly Review on Tuesday July 26.

Fines or penalties paid to a government for violating any law. Care must be taken when using a property limited company because your international tax. The tax will apply to subject vehicles subject vessels and subject aircraft delivered or imported on or after September 1 2022.

Retail Consumer Business BDO guides consumer businesses as they navigate the complexities of a rapidly evolving marketplace. Brokerage assets are held by Vanguard Brokerage Services a division of Vanguard Marketing Corporation member FINRA and SIPC. Restrictions on tax-free spinoffs from REITs.

Consider taxable accounts for investments that yield lower tax costs such as municipal bonds and stock index ETFs. The dividend tax credit meaningfully reduces the taxes that Canadians pay on dividends and causes dividend income to be the single most tax-efficient form of income available to Canadians. The main attraction of income trusts in addition to certain tax preferences for some investors is their stated goal.

If you hold REITs inside tax-advantaged accounts like a TFSA you can sidestep the above complexity. However exceptions apply for certain amounts paid or incurred after December 21 2017. Nontraded REITs raised 189B through the first five months of this year up from 107B during the same period in 2021 which was a record year for the sectors fundraising according to data.

Building public trust in company reporting enhances confidence that enables business relationships and facilitates efficient capital allocation promoting investment and growth. To manage your tax liability use an asset location strategy. Make money save money manage your money.

6 Donate and Repurchase. Foreign expats that invest in UK buy-to-let property can own these investments in their own name or a private investment company. Nareits members are REITs and other real estate companies throughout the world that own operate and finance income-producing real estate as well as those firms and individuals who advise study and service those businesses.

Investing abroad global cotton crisis and more. Ensure you use a buy-to-let property accountant to save tax. 0630 Best of BS Opinion.

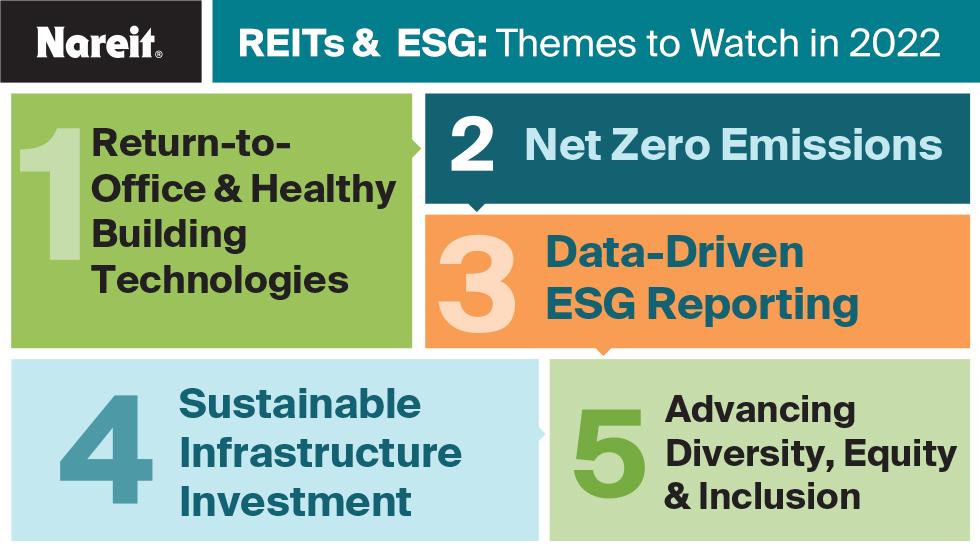

Landlords running a rental business need to be tax efficient. There are currently 4 infrastructure REITs listed on the FTSE Nareit US Real Estate.

Guide To Reits Reit Tax Advantages More

Reit Tax Advantages Why Investors Choose Reits Arrived Homes Learning Center Start Investing In Rental Properties

Daytrading Fidelity Investments Day Trading Trading Quotes Fidelity

What Is A Reit And Should I Invest In Them Personal Finance Club

Reits Esg Themes To Watch In 2022 Nareit

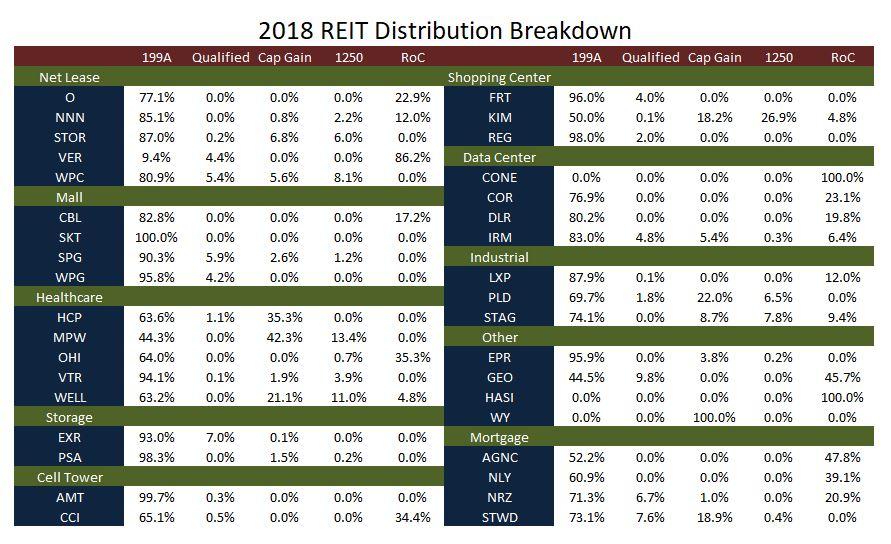

How Tax Efficient Are Your Reits Seeking Alpha

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

Guide To Reits Reit Tax Advantages More

Reit Tax Advantages Why Investors Choose Reits Arrived Homes Learning Center Start Investing In Rental Properties

Sec 199a And Subchapter M Rics Vs Reits

Reit Tax Advantages Why Investors Choose Reits Arrived Homes Learning Center Start Investing In Rental Properties

What S The Deal With Reits Passive Investing Australia

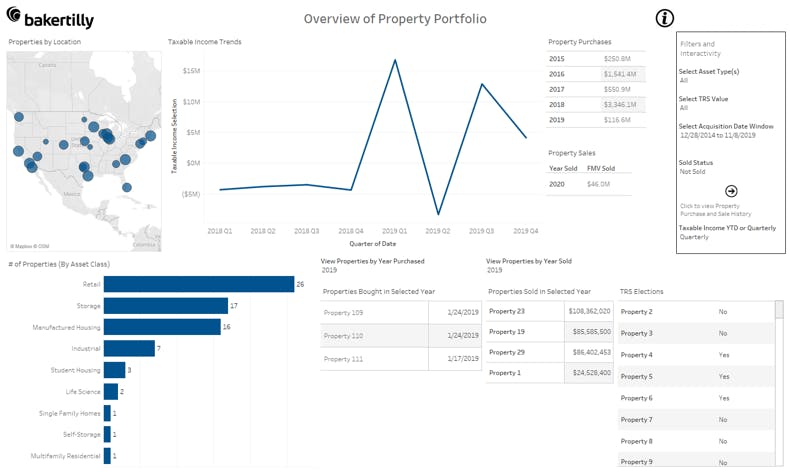

How Reits Can Leverage Financial Analytics And Dashboard Reporting To Drive Success Baker Tilly

Guide To Reits Reit Tax Advantages More

Reits Or Rental Property All Season Financial

Reit Valuation 4 Approaches Used In Practice

Pin By Rcs On Investor Awareness Words Of Wisdom Words Wisdom

What Is A Reit And Should I Invest In Them Personal Finance Club